We make top-rated, Open Source software to make your life easier with Joomla!® for the last 20 years.

Masterfully crafted

At a time where questionable AI-generated code and support are the norm, we choose to differ.

Our software is hand-crafted by developers with more than two decades of experience. This is us; we are pleased to meet you!

Your support and feature requests are always answered by the people developing the software.

We improve our software by listening to your feedback, and finding ways to address your needs.

Premium Joomla! extensions

Use coupon code HANDMADE2025 at checkout for a 20% introductory discount1.

Freedom and Privacy

We strongly believe in privacy, data ownership, and software freedom.

Our software is self-hosted, not a SaaS. There's no nebulous cloud to worry about; you are in possession and control of your data.

Our software has always been, is, and will forever be Free and Open Source Software, released under a permissive GNU GPL licence. You are free to study our code and verify our privacy, security, and data ownership claims.

Being an EU-based company, we abide by the Draconian EU GDPR data protection and minimization regulation as a matter of legal compliance. Our site will only collect the bare minimum, legally required information from you, removing it as soon as we are legally allowed to.

For the stark minority of features which require a server part to work, we offer a self-hosted implementation of it as a feature in our software. If you don't feel like using our server you don't have to.

Free of charge software

The NFC Card

If you came here scanning an NFC card you got at an in-person event, do keep it; it's useful beyond getting to this link! You can reprogram it to trigger smart home automations, visit a different URL, or share Wi-Fi passwords, contact information etc.

The card has an unlocked NTAG-215 NFC chip with 137 bytes of memory. You can reprogram it using your smartphone; we recommend the free-of charge application NFC Tools available on both iOS / iPadOS and Android.

The card itself is hand-made, and open source – just like our software! It was designed by us using FreeCAD and 3D-printed using a Bambu Lab P1S 3D printer using this file. The NFC chip inside it is an NFC sticker, the likes of which you can buy on Amazon.

The text on the card, as you can see in the 3MF file, is separate objects extruded at 0.1mm height and placed face-down on the build plate, with the rest of the card on top of it. You can replace the text objects with yours, customising the card. The card has a hole on its right-hand side where the sticker is placed, with the final two layers closing the hole. There's even a print pause (only works on Bambu Lab P1S and X1C printers!) which also moves the build plate 10cm down to give you enough space to place the NFC stickers.

1 Coupon code valid until July 1st, 2025. Only applies to new, single-product subscriptions. One coupon code use allowed per client. You can apply the coupon code after clicking on Pay & Subscribe, and going past the first screen (country selection) of the payment interface; click on Add Discount to enter and apply the coupon code. Terms & conditions apply.

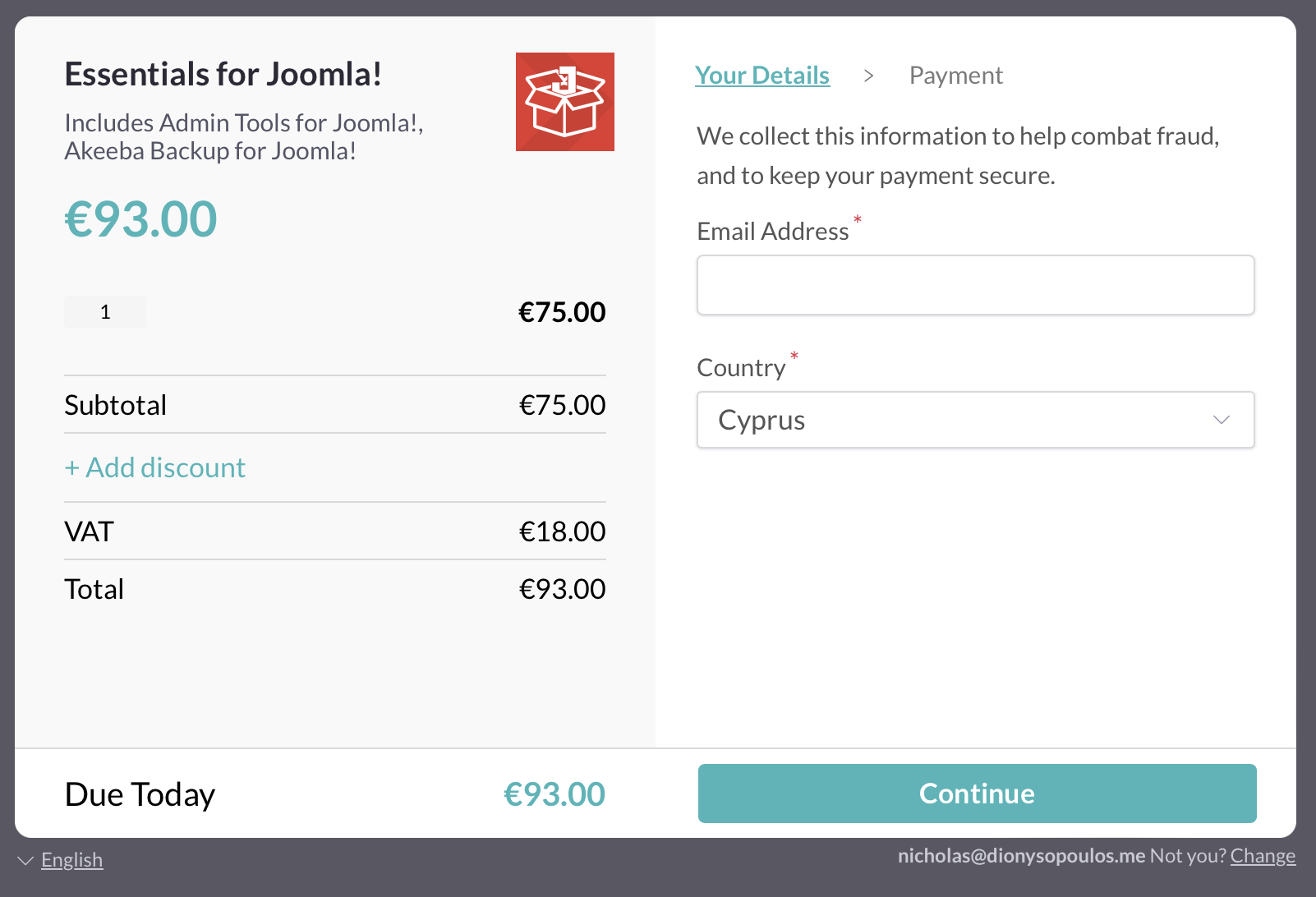

Here's how to apply a checkout coupon code.

Fill out the subscription form, make sure to check the box to indicate you accept the Terms of Service, and click on Pay & Subscribe. Don't worry about seeing the full price still; you will be able to enter the coupon code to receive a discount shortly.

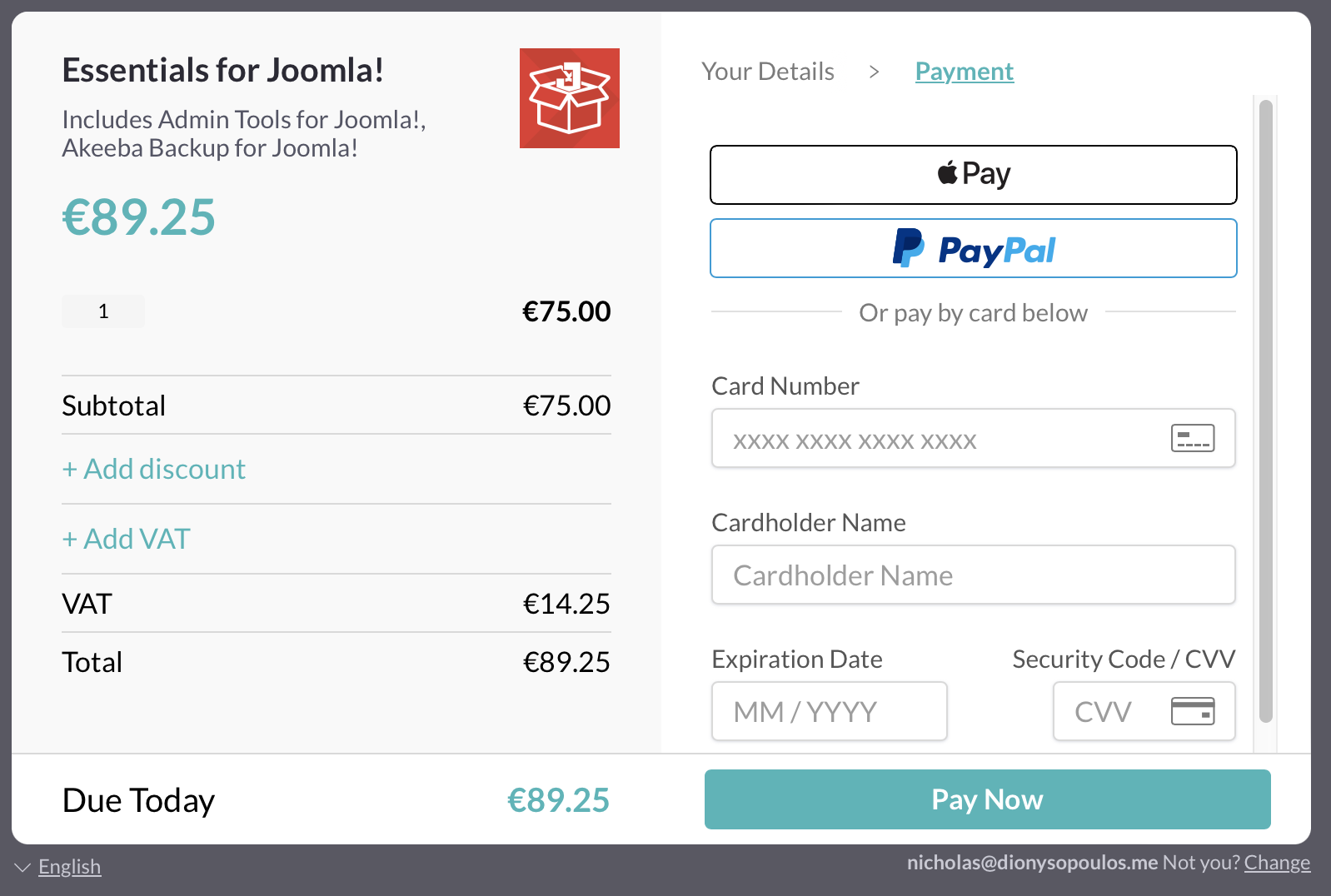

This takes you to our reseller's payment page. On the left-hand side of the page, click on the Add Discount link.

Enter the coupon code in the text box which appears, then click on the Apply button next to it.

The price is now discounted. You can continue with your purchase.

If you are purchasing as a company

After following the steps above, confirm your email address and country. Then, click on Continue

Note: for some countries you may additionally have to provide your postal code, or some other identitifying information required by your country's national laws.

In the new page, look on the left hand side. There's a new link on that page. Its name depends on your country's taxation system; it is Add VAT Number in the EU, “Add ABN” in Australia, “Add GST number” in Canada, and so on. Click on that link to add the tax and invoicing information for your purchase.

If you forget to do that, you may receive a receipt instead of an invoice and/or get charged for sales tax even if you qualified for a sales tax-exempt transaction. Don't worry, it can be fixed.

Right after a the transaction is complete you will receive an email with your invoice/receipt by our reseller, Paddle Ltd. Click on the link on that email to view the invoice/receipt online. On that page, you can enter your invoicing information within 7 days of the transaction taking place. If you qualify for exemption from sales tax you will receive an automatic refund of the sales tax amount within 2–3 business days.

If you are over the 7 days limit, or have any other concern about sales tax, or your invoice/receipt please email our reseller at

Server migration in progress

We are moving our site to a new server. The work will be done by Tuesday, April 8th 2025 at 10:30 a.m. UTC. Our sales are temporarily taken off-line during that time to prevent any mishaps with "lost" subscriptions during the server switchover.

We are moving our site to a new server.

During the migration period our sales will remain temporarily off-line to make sure no transaction will be “lost” in the process.

If your subscription was set to expire between April 7th, 2027 00:00 UTC and April 9th, 2025 23:59 UTC, and you have lost your automatic renewal discount as you are unable to purchase a renewal during the migration period please contact us within a calendar week of your subscription expiration date so we can give you a free of charge extension of your subscription by sevencalendar days which will reinstate your automatic renewal discount.

If your subscription has not expired, or if you are trying to purchase a new subscription, please visit our site again after Tuesday, April 8th 2025 at 10:30 a.m. UTC.

We apologize for the inconvenience and thank you for your understanding!

Here is the proof that it's me, the author of Akeeba Backup, who posted on Reddit (https://www.reddit.com/r/joomla/comments/wksk3l/comment/ijsl7ma/?context=3) offering my help to a random stranger who seemed desperate.

I became a FOSS developer because I actually enjoy helping people.

Not to mention that the instructions I would have given this person would be to submit a PRIVATE ticket on our site with his site info, not send it over DM.

- Nicholas K. Dionysopoulos, Akeeba Ltd, Director and Lead Developer

Akeeba Ltd and Paddle

Since July 1st, 2019 Akeeba Ltd does not sell products directly to end users. All sales are performed through our authorised reseller, Paddle. This was a necessary change because over the last few years different tax jurisdictions have required us to collect sales tax on their behalf, even though we do not have a physical presence there. It was impossible for a small company like us to handle the sales tax registration and collection on a global scale. Ignoring the tax laws or going out of business was not an option either. That's why we started using Paddle: to solve this otherwise impossible problem.

Paddle handles billing and invoicing. They are responsible for figuring out sales tax applicability and amount, take your money and issue the corresponding invoice for your order.

Akeeba Ltd only fulfills the order. This means that we only provide software downloads and support. We do not handle billing or invoicing. As a result we cannot help you with billing or invoicing issues ourselves. We can only give you some generic advice based on our past experience with billing issues both as Paddle customers ourselves and from the information shared with us by other clients with similar issues:

- Problems making a payment

- Sales tax charged outside the European Union

- Subscribing as a company

- Converting your receipt to an invoice

- Requesting a VAT refund (European Union clients only)

For any further information and support for billing or invoicing issues not covered by our generic advice please contact Paddle directly. You can do so by replying to the email you received from Paddle when you purchase a subscription. It's the email with the receipt / invoice for your transaction. Alternatively, you can reach Paddle at

Problems making a payment

Purchasing a subscription starts on our site. You select a product and you're transferred to the subscription form where you can enter / review your contact information we keep on file, enter any coupon code we might have given you and accept our terms of service and privacy policy.

After clicking the Pay and Subscribe button on our site a new full-screen overlay opens with Paddle’s payment interface. If the subscription page reloads without opening the payment overlay please make sure that you have checked the “I accept the Terms of Service and the Privacy Policy” checkbox before clicking the Pay and Subscribe button.

The payment overlay requires JavaScript to be enabled on your browser and allowed to be loaded from domains other than our own – Paddle hosts its payment JavaScript on its own CDN. If you do not see the payment interface opening within 10 seconds, or if it seems to be unresponsive, the problem might be a third party browser extension or software which blocks JavaScript such as, but not limited to, NoScript and Privacy Badger. Please try using a different browser without any browser extensions installed. If this doesn’t help try using your phone or tablet to make your purchase.

If you have a problem completing a payment using PayPal please clear your browser’s cookies and retry. This is a problem with PayPal itself.

If your credit card transaction is on hold please wait for a day. It’s very likely that you accidentally triggered the automated fraud prevention system at Paddle’s side and a human will be investigating your transaction shortly.

If your credit card transaction fails outright please contact your bank or card issuer. In virtually every case your bank or card issuer has automatically blocked the transaction with a company outside your country even if you had previously explicitly asked them to do otherwise. You need to ask them to allow the transaction with Paddle, a company based in the UK or Ireland (they have two business entities, which one will be used to process your transaction depends on your location). Then you can retry the payment.

In any other case please contact Paddle as explained further above this page.

Sales tax charged outside the European Union

There’s a common misconception that an EU company will only charge VAT for sales to non-business clients in the EU. This has not been the case for quite a few years now. As explained at the top of this page, several tax jurisdictions require that a merchant selling software and/or services in their territory collects the applicable sales tax / VAT even if it does not have physical presence in that jurisdiction.

This is the reason we started using Paddle in July 2019. We could not handle the complexity of registering for sales tax and managing that tax ourselves on a global scale. Since you are making a transaction with Paddle and being issued an invoice by them they are responsible for charging you the applicable tax, collect it from you and give it back to the relevant tax authorities.

You can find the exhaustive list of tax jurisdictions where tax is charged, as well as when it’s charged and how much is it. Note that in many cases the tax applies only to sales to individuals (B2C), not sales to tax registered companies (B2B). If you have further questions about tax law compliance please contact Paddle as explained further above this page. They will be able to help you understand why tax is being charged to your purchase.

Subscribing as a company

After clicking the Pay and Subscribe button on our site you are taken to the payment page managed by our reseller, Paddle. The first page lets you enter (or verify) your email address and country:

Even though you see VAT being applied, click on Continue.

In the next page, look at the left hand side. There is a “+ Add VAT” link.

Click on the “+ Add VAT” link to enter your invoicing information, including your EU VAT number. Please remember that if you are an EU company with a VIES-registered VAT number you need to enter your VAT number without the country prefix.

If you are an EU company but your VAT number is not recognised after clicking Apply please check it with the EU VIES service. If the service reports the VAT number as invalid you can proceed without entering your business information at this step. After subscribing you will need to follow the instructions under “Converting your receipt to an invoice” below. If the EU VIES service reports a temporary problem you can proceed with your payment without entering your business information and follow the instructions under both “Converting your receipt to an invoice” and “Requesting a VAT refund” below after a day or two.

Important: Paddle is the Merchant of Record, meaning that you are paying Paddle, therefore the invoice is issued by Paddle. Paddle is based in the United Kingdom. All UK businesses will be charged the applicable VAT regardless of whether they enter a valid VAT number, in accordance to local tax laws.

Converting your receipt to an invoice

Paddle emails you with a payment receipt upon successful payment. This receipt is a valid tax invoice if you had already entered your invoicing information before payment.

If you did not enter your company’s invoicing information during payment for any reason you can do so within 7 days of the receipt having been issued. Follow the link in the email you received from Paddle to open the receipt in your browser. If you deleted this email you can still find that link after logging into our site, under My Subscriptions.

The left hand side of the receipt page has a blue link to enter your invoicing information. Click on it and enter your company information. This is enough to convert the receipt to a valid tax invoice. You can print that page, either to a piece of paper or a PDF file, and file it as a business expense.

If the link does not appear it may be the case that the receipt has been issued more than 7 days ago. In this case please contact Paddle as noted further above

Requesting a VAT refund (European Union clients only)

If you forgot to enter your VAT number or the VAT number validation did not work at the time you first need to follow the “Converting your receipt to an invoice” instructions above. While doing that you will enter your VAT number. A VAT refund will be issued in the next few days.

According to our experience the invoice is not amended to show that no VAT was actually charged. If your tax jurisdiction does not allow that please contact Paddle at